New research maps out $100 billion of infrastructure spending in regional NSW

New research has plotted the current and future pipeline of infrastructure development in regional NSW, providing a sharper picture of how to achieve sustainable economic activity across the state.

“The NSW Government is investing $100 billion into regional NSW now and into the future, focusing on schools, hospitals, water infrastructure and roads and bridges,” said Drew Varnum, Executive Director, NSW Public Works, who commissioned the research.

“The research provides sound evidence on what projects will happen in which locations, what growth will entail and how it impacts on local areas.”

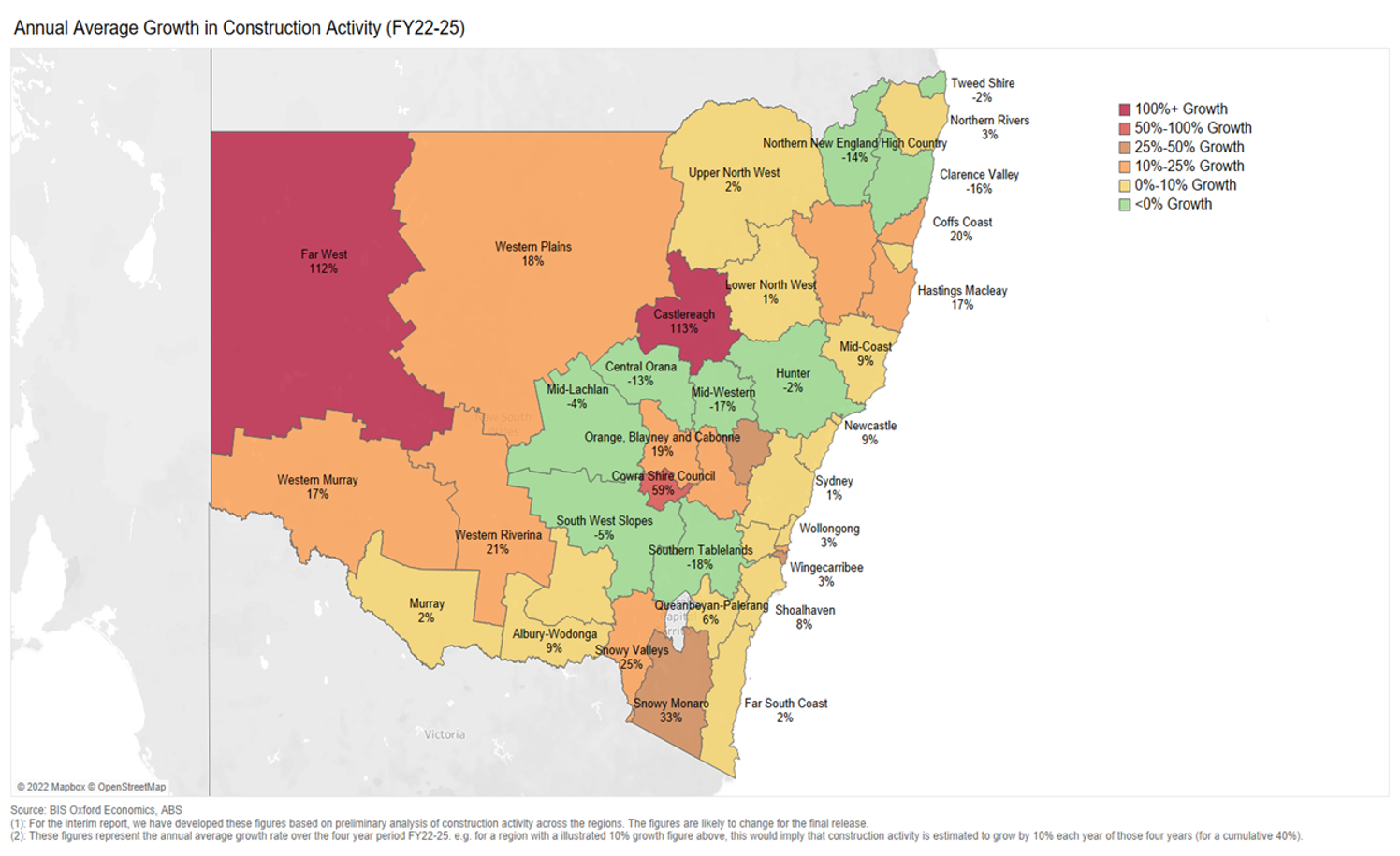

The research, Regional NSW Market Capacity Report, analysed construction pipelines and forecast infrastructure project expenditure by activity types across the five major NSW economic regions, encompassing 38 smaller functional economic regions.

“It provides insights into the impacts, risks, and challenges with the delivery of regional NSW infrastructure, and analyses potential solutions to ensure the economic prosperity of regions.”

“The findings will hopefully help councils and state government agencies to better plan their grant programs and projects, enabling them to more successfully complete their pipelines of work and serve their communities better.”

Filling an information gap

The research was commissioned by the Department of Regional NSW through NSW Public Works to fill an information gap around where projects are happening across NSW and who has the capacity and skills to deliver those projects.

“We were hearing about a number of challenges that our clients were dealing with in delivering their projects,” said James Slann, Principal Infrastructure Advisor, NSW Public Works, and project manager of the research.

“Even if they were applying for and receiving grants, they couldn’t necessarily meet the timelines because of things like a lack of resources and critical market information.”

Slann said that compounding this problem is an ongoing national skills shortage, which is making the industry “extremely stretched”.

“For almost 30 years, there have not been enough women and men coming through with the needed skills – as engineers, technicians, tradies, and project managers.

“And the biggest construction companies (known as tier 1) tend to absorb all the skills from small companies (tiers 2 and 3).

“So, despite councils having pipeline plans – things they wish to do – other unknown projects can pop up and steal away their already limited resources.”

Slann said the market capacity research can help organisations to implement better planning.

“For example, if an organisation knows there are many road projects happening in one area, they now know it is not a good time to undertake works on the local roads as they may not get the machinery or skills they need,” said Slann.

“The consolidated view and increased sharing of intel will hopefully help to create more equitable outcomes across the construction industry.”

Deep engagement, positive feedback

The research was led by professional services company Turner Townsend in association with economics research and forecasting firm BIS Oxford Economics.

“The research team held pilot interviews with six councils across NSW and 20 interviews with industry organisations and NSW and Federal Government agencies,” said Adrian Hart, Head of Construction and Infrastructure, BIS Oxford Economics.

“We sent a survey to all 92 regional NSW councils, and achieved a 75 percent response and participation rate, accounting for 88 percent of the population in regional areas.

“That level of engagement is unprecedented,” said Hart, acknowledging that typical engagement for this type of research is around one-third of those invited.

The research findings were presented at the Institute of Public Works Engineering Australasia (IPWEA) NSW and ACT State Conference in March 2022.

“We received so much positive feedback after the presentation,” said Hart. “Councils are very grateful that someone did this research.”